Overview of USA REIT

USA REIT provides a tech-enabled solution to make investing in high quality, commercial real estate (CRE) more affordable and liquid through fractional investment and digital CRE assets.

Our clients capitalize on the security, efficiency and liquidity of real estate markets by offering an investor management portal enabling simple, cost-efficient, and globally syndicated transactions.

Opportunities in Commercial Real Estate

USA REIT is a trusted and connected private marketplace that modernizes traditional investment, creating a clear path to an entirely new frontier of real estate investing, digitized ownership and direct market liquidity.

Traditional real estate investing historically is problematic…

To understand the potential impact of technology-driven improvements in the real estate investment industry it is critical to first understand the existing inefficiencies:

Inaccessible

Quality Commercial Real Estate properties are snapped up in off-market, privately negotiated deals

Illiquid

Unlike stocks and bonds, Commercial Real Estate is not easy to trade and exchange

Exclusive

Deep-pocketed private equity firms, banks and ultra-HNW investors get best deal flow

High Admin

High administrative cost and complexity of 3rd party intermediaries

USA REIT solves accessibility & liquidity problem

USA REIT modernizes real estate transactions and deals by transitioning them into the digital age:Continuous Liquidity

Commercial real estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through the use of depreciation.

Speed and Innovation

Real estate investors can be flexible in their investment strategy and timing, pursuing profitable deals where they’re available.

Asset Democratization

Commercial real estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through the use of depreciation.

Global Access

Real estate investors can be flexible in their investment strategy and timing, pursuing profitable deals where they’re available.

Compliant

Commercial real estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through the use of depreciation.

Transparent

Real estate investors can be flexible in their investment strategy and timing, pursuing profitable deals where they’re available.

Surging Demand for Alternative Investments, Particularly Real Estate Related Investments

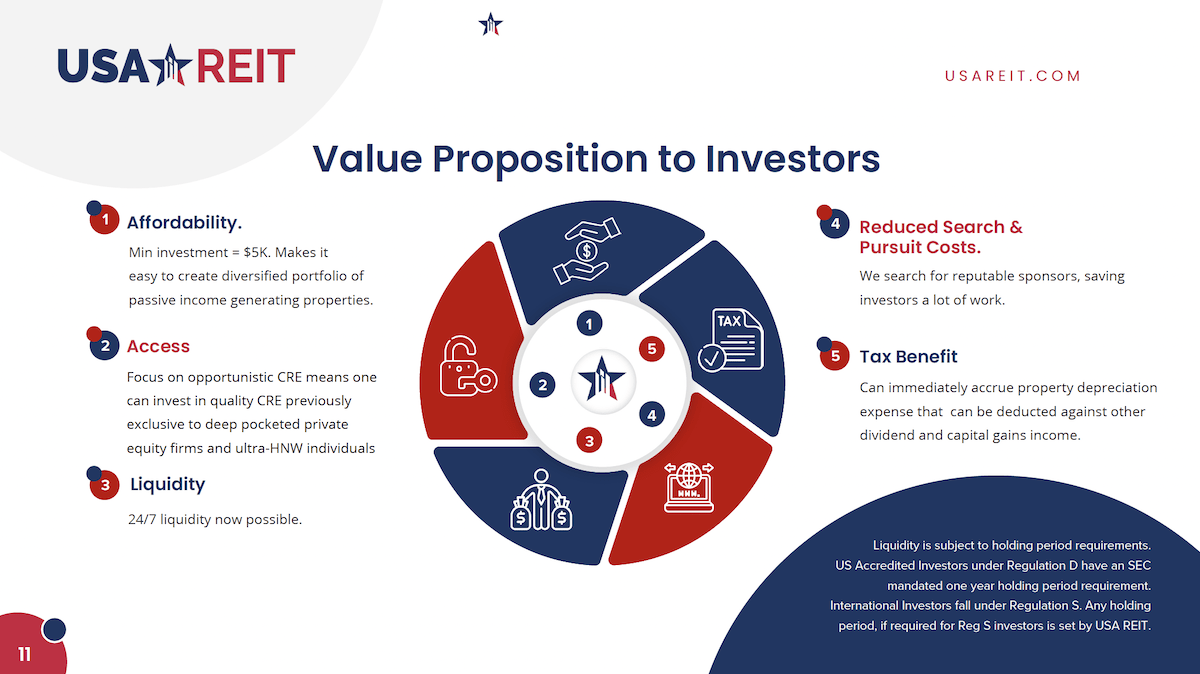

What USA REIT offers:

- Operates an end-to-end commercial real estate fractional and digital asset marketplace

- Lists CRE sponsors’ equity LP capital stack and showcases investment opportunities through USA REIT marketplace

- Attracts US Accredited and International investors to invest in real estate offerings

- Manages ongoing investor relations (dividend distributions, quarterly updates, K-1 distributions, token custody, advisory services, etc.)

- In-house platform facilitates secondary market trading of real estate shares and digital tokens through registered ATS (Alternative Trading System)

- Diversified income real estate fund

The CRE Diversified Income Fund

The CRE Diversified Income Fund