Executive Summary

Capview Warehouse Fund

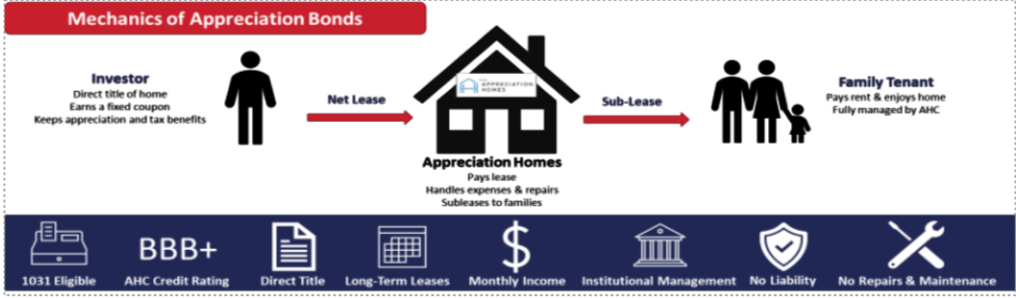

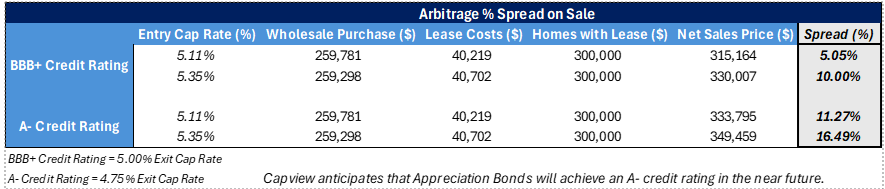

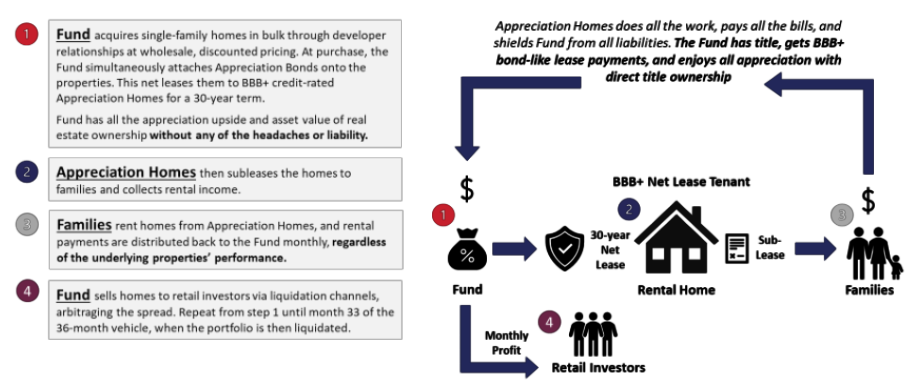

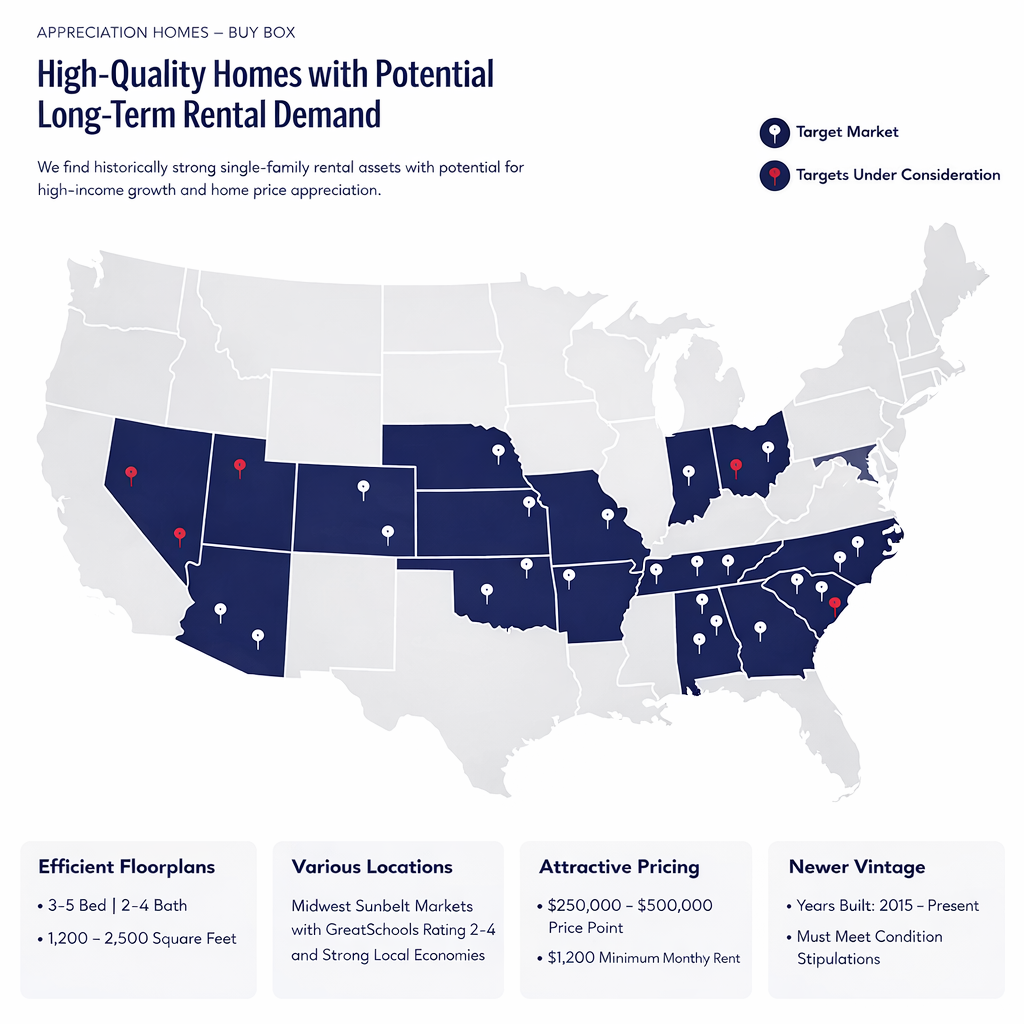

The Capview Warehouse Fund is focused on purchasing communities of single-family rental (“SFR”) properties within the U.S. Sunbelt states. The Fund acquires these portfolios at discounts from developers and attaches Capview’s proprietary absolute net leases, called Appreciation Bonds, onto the portfolio. Appreciation Bonds carry a BBB+ investment-grade credit rating.

The Fund targets homes between $250,000-$500,000 in value and collects monthly rents on the portfolio while preparing them for sale. Profits on sales are distributed back to investors, while the principal equity is reinvested into new homes to repeat the cycle. The Fund engineers reliable cap rate compression via our investment-grade absolute net leases, which de-risk the value proposition of the homes.

About Absolute Net Leases

An absolute net lease is a real estate lease in which the tenant pays rent and is responsible for all the costs associated with owning the building, leaving the landlord with steady, hands-off income.

Why Absolute Net Leases Haven’t Been Applied to SFRs Before

Because an absolute net lease places almost all the risk on the tenant, landlords prefer tenants with a corporate credit rating to ensure the rent — and all other associated obligations — will be paid for reliably. Capview’s subsidiary, Appreciation Homes, serves as this corporate credit-rated tenant with a BBB+ credit rating, a first in the industry.

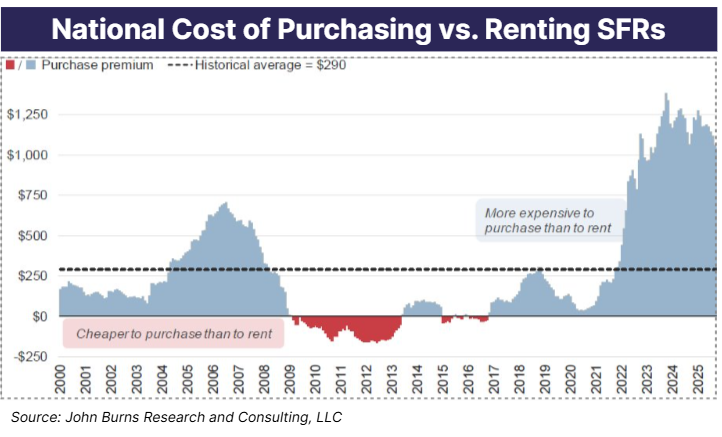

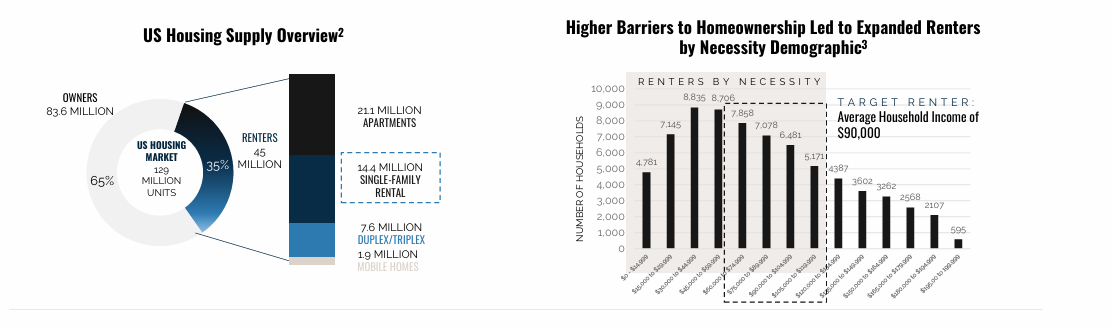

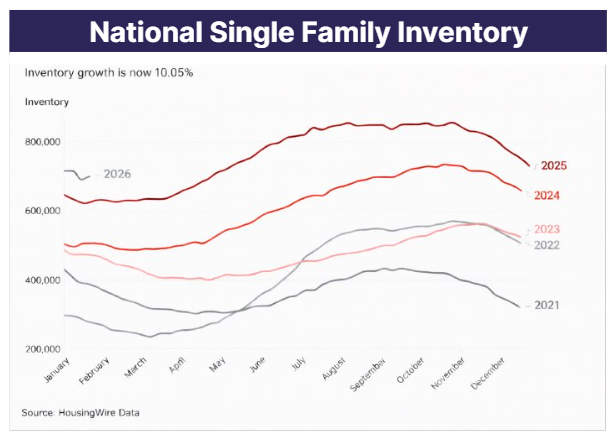

Why the SFR Asset Class

SFRs have historically proven to be one of the most resilient asset classes. After the COVID pandemic, U.S. Sunbelt states saw an influx in migration by families and individuals. Developers and sponsors are building record amounts of SFR communities – communities that are purpose-built for long-term renters.

About Appreciation Bonds

Handles expenses & repairs

Subleases to families

Fully managed by AHC

Eligible

Eligible Title

Title Long-Term Leases

Long-Term Leases Monthly Income

Monthly Income Institutional Management

Institutional Management No Liability

No Liability No Repairs & Maintenance

No Repairs & Maintenance