Overview of CRE Industrial Value Add Series I

CRE Industrial VA (Value-Add) Inc. was formed to develop, acquire and manage a diverse portfolio of quality commercial real estate in targeted markets for the purpose of generating income and capital appreciation. With a focus on industrial commercial real estate, the company believes that certain targeted properties and geographies have displayed strong performance and are expected to be well positioned to see continued healthy rent growth moving forward.

The company's strategy is to develop and acquire properties in and near any of 25 largest Metropolitan Statistical Areas (MSA’s) in the United States, These markets historically have exhibited the characteristics of high rental growth, low vacancy, and strong absorption, along with other important market fundamentals. The Company believes these markets present the best target markets for long term investors.

Public vs Private Real Estate

Public real estate investments, such as REITs, are traded on public exchanges and are subject to market volatility and risks similar to those of traditional equities and fixed-income securities. They do not diversify away overall market risk, a major priority for experienced, high-wealth investors.

Private real estate investments, on the other hand, have a low correlation to the public markets, providing better protection against capital loss and market volatility. By investing across multiple private real estate asset types and sectors, such as Industrial and Technology, we offer additional diversification and risk mitigation.

Market Opportunity In Commercial Real Estate

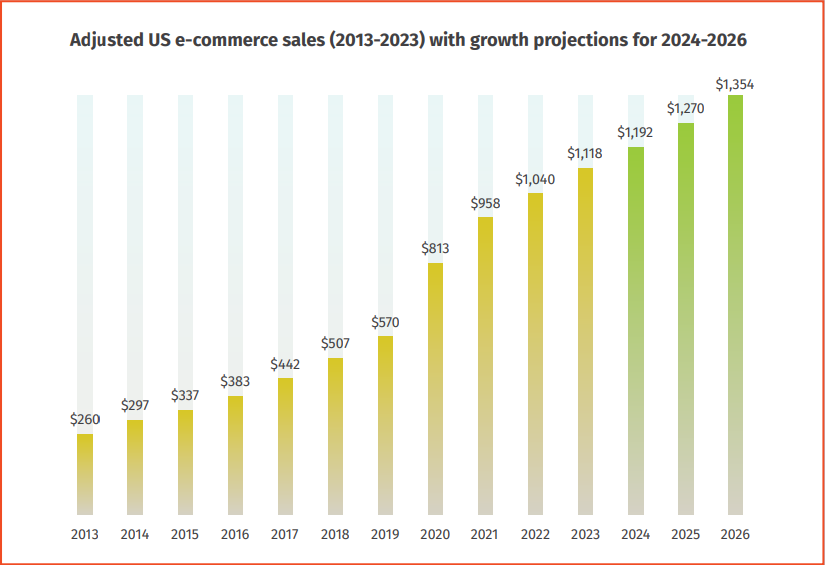

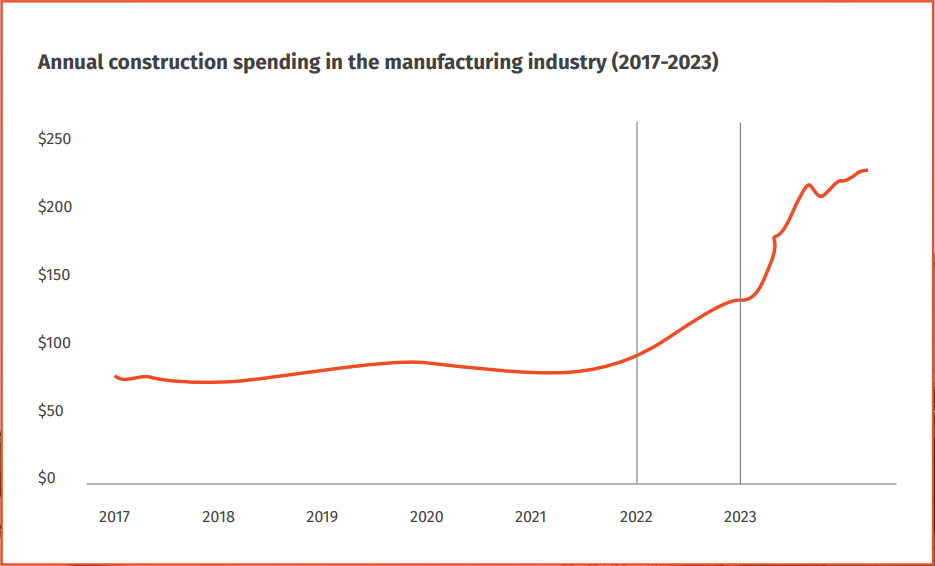

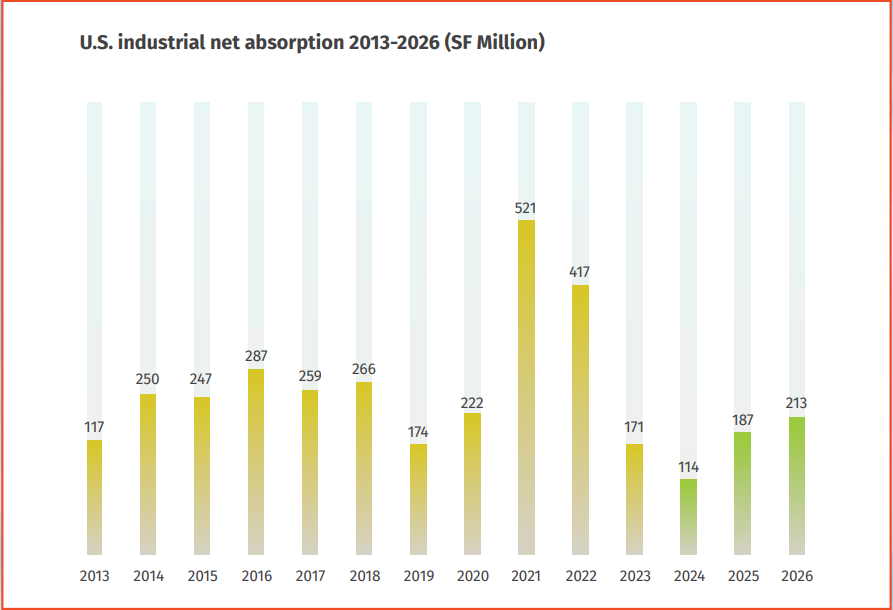

The commercial real estate market is poised for significant growth, driven by the expansion of e-commerce, increased manufacturing investments, and the reshoring of supply chains. The demand for commercial space continues to outpace supply, leading to positive net absorption and rental growth

To illustrate this trend, consider the following data: